30/05/2025 – Deficit Attention Disorder

Deficit Attention Disorder

Extensive tax cuts were always going to be a potential positive element of a Trump presidency. Where investors may have been a little naïve is around how these tax cuts are funded, especially given there’s long been fair arguments that US borrowing is unsustainable. Debt rating agency Moody’s seems to agree as they downgraded their rating of US debt from their top rated Aaa to one step down, Aa1. Whilst markets haven’t been particularly rattled, this downgrading occurring at the same time as the Trump administration publishing “One Big Beautiful Bill” (it’s official name), does bring the sustainability of US borrowing into question.

It feels like AI was designed for this moment – here’s a flavour of what Chat-GPT picked out from the 1,116 page behemoth bill.

- Extension of individual income rax rate reductions.

- No tax on tips or overtime.

- Introduction of tax-exempt ‘MAGA’ accounts.

- Expanded Health Savings Account flexibility.

- Phased repeal of various clean energy related funding. (The majority of which doesn’t stop until 2032)

- Increasing mining of offshore and Alaskan reserves.

- Reduce regulation on fossil fuel extraction.

- Funding for more detention centres and deportation flights.

- Removal of 10% tax on tanning services. – What?

- Increasing the debt limit allowing for further borrowing.

Our reaction to the majority of the bill can probably be labelled as ‘disappointing but not surprising’, other than maybe the tanning bit, that is surprising, perhaps that’s how he gets his peachy skin tone? More importantly, the current proposals are projected to add over $5tr to the national deficit. There are rumours that the Republican party are divided over whether to prioritise tax cuts or budget cuts, which is relevant given the bill needs to pass through both chambers of Congress and cannot be implemented as an executive order.

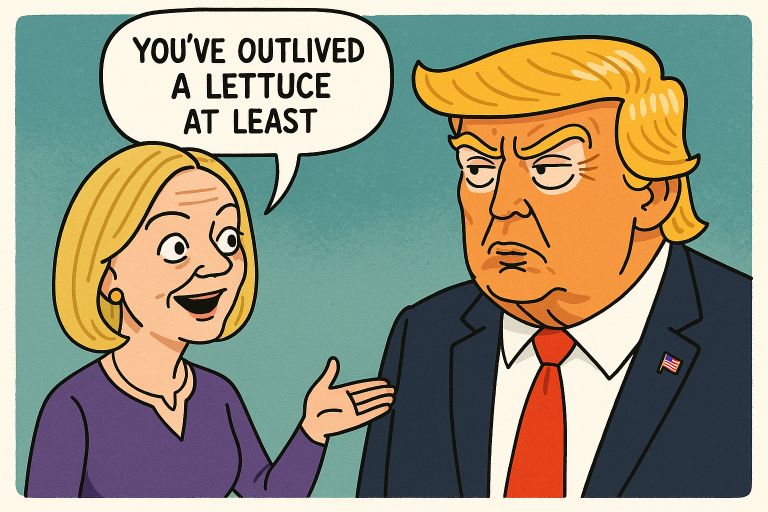

Market reaction has so far been fairly limited but this is still a developing situation. There are some early signs that investors might be thinking ‘thou shall not push through unfunded tax cuts’, as they did for Liz Truss in the UK. The latest auction of Treasuries was noted by numerous market commentators as particularly weak and bond yields have been rising, a sign that investors are demanding extra reward for the deemed risk.

In February we trimmed our exposure to Treasuries in the Fixed Income fund as we felt and continue to believe that a number of Trump’s policies are inherently inflationary in nature. Consequently, we believe that it is likely interest rates reduce to a greater magnitude in Europe and the UK.

RISK DISCLOSURE: AS IS THE VERY NATURE OF INVESTING, THERE ARE INHERENT RISKS AND THE VALUE OF YOUR INVESTMENT WILL BOTH RISE AND FALL OVER TIME. PLEASE DO NOT ASSUME THAT PAST PERFORMANCE WILL REPEAT ITSELF AND YOU MUST BE COMFORTABLE IN THE KNOWLEDGE THAT YOU MAY RECEIVE LESS THAN YOU ORIGINALLY INVESTED. CHANGES IN RATES OF EXCHANGE MAY HAVE AN ADVERSE EFFECT ON THE VALUE, PRICE OR INCOME OF AN INVESTMENT. THE OPINIONS STATED ARE THOSE OF BECKETT ASSET MANAGEMENT LTD, WHICH IS AUTHORISED AND REGULATED BY THE FINANCIAL CONDUCT AUTHORITY.